This guide is for MNsure-certified brokers, navigators and certified application counselors (CACs) to help consumers report a tax-filer status change using MNsure's online reporting forms.

A change in tax-filer status can be reported up to 60 days in advance of the event occurring.

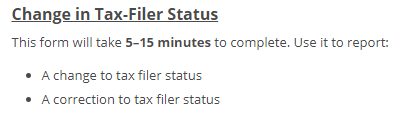

After you register to report changes online, log in and choose the Change in Tax-Filer Status topic.

Enter the first and last name of the consumer experiencing the change or correction (which may or may not be the person reporting the change). Click “Continue.”

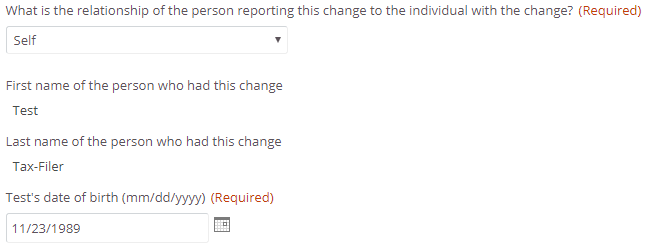

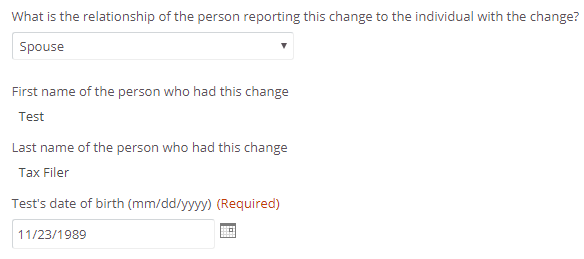

In the next section, for the relationship information:

If the consumer experiencing the tax-filer status change is the same person reporting the change, “Self” will be automatically selected for the relationship field, and the name and date of birth fields will be completed.

If the consumer experiencing the change is NOT the person reporting the change, then the relationship of the person reporting the change will be automatically selected. The example below shows the consumer’s spouse as the person reporting the change to you, the assister.

Complete the next section to include the consumer’s residential address information.

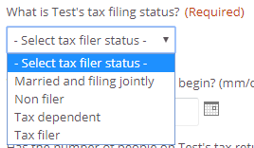

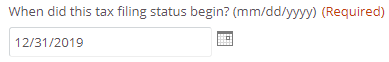

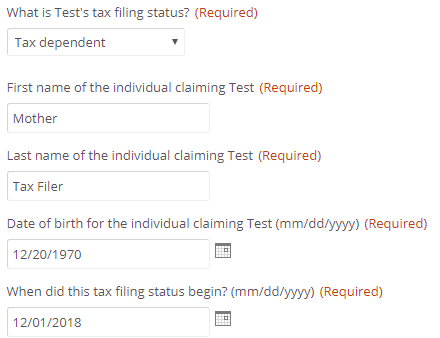

The next section asks you to select a tax-filing status. Select the updated status you are reporting.

The following information includes examples for reporting different types of tax-filer statuses, which include:

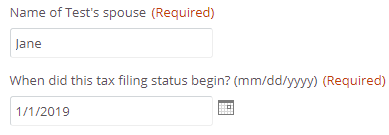

Spouse’s name and date the tax-filing status begins must be entered.

The only required information in this section is the date that the non-filer status begins.

The final questions are about tax filing and household. Answers are required for all questions. Tips for answering these questions are below.

When answering the tax-filer status questions, keep in mind that all individuals reporting a change will answer "Yes" UNLESS they are reporting this change to make a correction to a tax-filer status on their application.

Terms used:

Has the number of people on X's [person you are reporting about] tax return changed since the last filing?

Answering “Yes” to this question would indicate an increase or decrease of the number of people on the tax return of the person for whom the change is being reported.

Examples for answering “Yes” to this question:

Example for answering “No” to this question:

Has X [person you are reporting about] had a change in family size or expected to have a change in family size for this year?

An example of someone who may answer “Yes” to this question is an individual who is expecting the birth of a child.

Has X [person you are reporting about] had a change in circumstances or expected to have a change in circumstances for this year that will decrease annual household income?

An example of someone who may answer “Yes” to this question is a seasonal employee.

Has X [person you are reporting about] tax filing status changed or expected to change for this year?

Is X [person you are reporting about] claimed outside the tax household?

An example of answering “Yes” to this question could be a situation where a non-custodial parent outside of the household is claiming a dependent child.

If additional questions remain about this section, it may be necessary to seek the assistance of a tax professional.

You can use the comment field to provide clarifying information. However, all the required fields of the form MUST be completed in order for MNsure to process the change. Do not use the comment field to report the tax-filer status information.

Once the change has been submitted, a confirmation email will be sent to the email address you (the assister) used when registering to use the online change report forms.